7 Smart Ways to Save Money in the USA: Best Daily Deposit Strategies for 2025

7 Smart Ways to Save Money in the USA: Best Daily Deposit Strategies for 2025

Introduction: The Best Daily Deposit Strategy in the USA

Saving money consistently is one of the smartest financial habits you can develop. But how can you turn small daily deposits into significant savings over time? Whether you’re saving for an emergency fund, a vacation, or retirement, understanding the best daily deposit strategy in the USA can help you grow your money efficiently.

In this guide, we’ll explore 7 smart saving strategies, including high-yield savings accounts, certificates of deposit (CDs), budgeting apps, and automated savings tools. By the end, you’ll have a step-by-step plan to maximize your savings with minimal effort.

1. Understanding the Power of Daily Deposits

Before diving into specific strategies, let’s look at why daily deposits matter.

Why Daily Deposits Work?

Consistent Growth: Even small amounts add up over time.

Compounding Benefits: Interest is calculated on both principal and previously earned interest.

Habit Formation: Automating daily savings helps build long-term financial discipline.

Consistent Growth: Even small amounts add up over time.

Compounding Benefits: Interest is calculated on both principal and previously earned interest.

Habit Formation: Automating daily savings helps build long-term financial discipline.

💡 Example: If you deposit $1 on day 1, $2 on day 2, and continue this pattern for a year, you will have saved $66,795 by the end of 365 days! But the real power comes when you earn interest on these deposits.

2. Best Daily Deposit Strategy in the USA: High-Yield Savings Accounts

Why Choose a High-Yield Savings Account (HYSA)?

A high-yield savings account (HYSA) offers 4.00% - 5.50% APY, which is much higher than traditional savings accounts (0.01% APY).

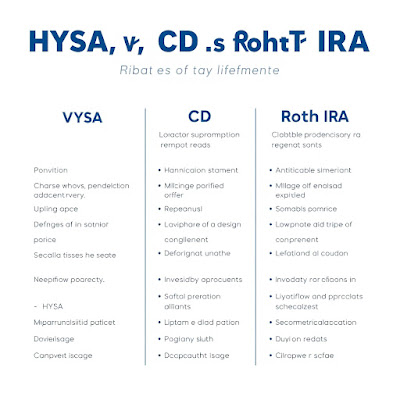

Top High-Yield Savings Accounts (2025)

How to Use HYSA for Daily Deposits?

Automate a fixed deposit (e.g., $10 daily) from your checking account.

Set round-up savings (many banks allow rounding purchases and saving the difference).

Use budgeting apps like Digit to analyze spending and automate savings.

Automate a fixed deposit (e.g., $10 daily) from your checking account.

Set round-up savings (many banks allow rounding purchases and saving the difference).

Use budgeting apps like Digit to analyze spending and automate savings.

💡 Real-Life Example: John, a freelancer in New York, automated a $5 daily transfer to Ally Bank HYSA. After 1 year, he saved $1,825, and with 4.35% interest, his total balance grew to $1,904.

3. Certificate of Deposit (CD): Best for Fixed Savings

How CD’s Work?

A Certificate of Deposit (CD) locks your money for a fixed period (e.g., 6 months, 1 year) at a higher interest rate (up to 5.75%).

Best CD Rates in the USA (2025)

How to Use a CD for Daily Deposits?

Every 30 days, deposit your total savings (e.g., $465) into a 1-year CD.

Continue rolling over CDs for higher interest.

Every 30 days, deposit your total savings (e.g., $465) into a 1-year CD.

Continue rolling over CDs for higher interest.

💡 Example: Sarah deposited $500 into Wells Fargo’s 5.50% CD every month. After 1 year, she had $6,000 in CDs earning $337 in interest.

4. Automate Your Savings with Budgeting Apps

Best US Budgeting Apps for Automated Savings

You Need a Budget (YNAB): Helps you plan and save for future expenses.

Every Dollar: Ideal for zero-based budgeting.

Acorns: Rounds up spare change and invests it.

Digit: Analyses spending and moves small amounts into savings automatically.

You Need a Budget (YNAB): Helps you plan and save for future expenses.

Every Dollar: Ideal for zero-based budgeting.

Acorns: Rounds up spare change and invests it.

Digit: Analyses spending and moves small amounts into savings automatically.

5. Roth IRA & 401(k): Saving for Long-Term Growth

Why Use a Roth IRA?

Tax-free withdrawals in retirement

Higher returns than a regular savings account

Contribution limit: $7,000/year (2025)

Tax-free withdrawals in retirement

Higher returns than a regular savings account

Contribution limit: $7,000/year (2025)

💡 Example: If you invest just $5/day into a Roth IRA earning 7% annually, you could have $250,000+ in 30 years!

6. Overcoming Common Challenges

Common Problems & Solutions

7. Final Thoughts: Which Strategy is Best for You?

If you need flexibility → Choose a High-Yield Savings Account

If you want guaranteed returns → Go for a Certificate of Deposit

If you want to build wealth → Invest in a Roth IRA

What’s your favourite saving strategy? Comment below & share your experience!

FAQ Section

1. What is the best daily deposit strategy in the USA?

The best strategy depends on your goal. For flexibility, use a HYSA; for fixed savings, use a CD; for long-term growth, invest in a Roth IRA.

2. Can I save money automatically?

Yes! Use apps like Digit, YNAB, or Acorns to automate savings.

3. What are the best banks for saving money in the USA?

High-Yield Savings: Ally Bank, Marcus, Discover

CDs: Wells Fargo, PNC Bank, Bank of America

High-Yield Savings: Ally Bank, Marcus, Discover

CDs: Wells Fargo, PNC Bank, Bank of America

4. How much should I save daily?

Even $5 per day ($150/month) can grow into a solid emergency fund.

5. Can I withdraw money from a CD before maturity?

Yes, but there’s usually a penalty fee for early withdrawal.

6. How does compounding interest work in savings?

Your interest earns interest, which grows your savings faster.

Comments

Post a Comment

https://thesavvysaversociety.blogspot.com/p/comment-policy.html