The 3 Best High-Yield Savings Accounts for 2025 (5% APY Guaranteed)

Looking for the best savings accounts in 2025? We’ve found the top 3 banks offering 5%+ APY—secure, FDIC-insured, and hassle-free!

|

| Discover the top 3 FDIC-insured high-yield savings accounts offering 5%+ APY in 2025—maximize your savings securely and smartly. |

Introduction:

Why You’re Losing Money in a 0.45% Savings Account

Did you know that the average APY (Annual Percentage Yield) from traditional savings accounts is just 0.45% in 2025? That’s not even enough to keep up with inflation. While your money sits idle in a big bank, some online banks are offering 5.00% or more in APY—guaranteed.

If you're someone like Mark Thompson—a mid-career professional or small business owner earning $60K–$120K annually—you’re probably already budgeting, paying off debt, and saving for your future. But low-interest savings accounts are holding you back.

The good news? Interest rates have climbed thanks to the Federal Reserve’s policies to fight inflation. That means high-yield savings accounts (HYSAs) are more rewarding than ever. In this guide, we’ll dive deep into:

Why HYSAs are essential for your financial health

The 3 best banks offering 5%+ APY in 2025

How to choose, open, and optimize your high-yield savings account.

Let’s unlock better earnings for your cash—securely and effortlessly.

Why High-Yield Savings Accounts Matter in 2025

Inflation is Your Silent Enemy 📈

Every year, inflation quietly erodes your money’s purchasing power. If the inflation rate is 3.2% (as it was in 2024), and your savings account earns 0.45%, your money is losing value. That’s a guaranteed loss.

Traditional Banks Are Playing You💸

Big banks like Chase, Wells Fargo, and Bank of America often offer below 0.50% APY—even to loyal customers. Here’s a simple breakdown:

See the difference? That’s an extra $490 per year just by choosing the right savings account.

High-Yield Accounts Are FDIC-Insured🏦

Every account we recommend here is:-

FDIC-insured up to $250,000

Zero-risk for principal losses

Ideal for emergency funds, sinking funds, or short-term goals

Your money is safe—and earning serious interest.

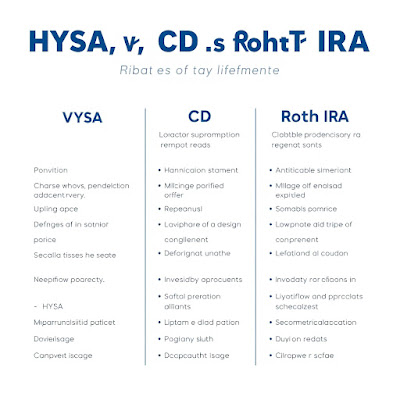

The 3 Best High-Yield Savings Accounts for 2025

🥇SoFi Checking and Savings

APY: Up to 5.00% with direct deposit

Monthly Fees: $0

FDIC Insurance: Up to $2 million through partner banks

Minimum Balance: None

🔍 Features:

Automatic savings tools

Early direct deposit (up to 2 days early)

Integrated with investment accounts

✅ Pros:

One of the highest guaranteed APYs

No overdraft or monthly fees

User-friendly mobile app

❌ Cons:

Requires direct deposit for full APY

Limited cash deposits (online bank)

📝 How to Apply:

Go to SoFi.com and select “Get Started”

Sign up in under 10 minutes

Set up direct deposit to activate 5.00% APY

🥈 UFB Direct High Yield Savings

APY: 5.25% APY (no direct deposit required)

Monthly Fees: $0

FDIC Insurance: Yes

Minimum Balance: None

🔍 Features:

Industry-leading APY with no strings attached

24/7 customer support

Online-only, mobile-first design

✅ Pros:

No minimums or hidden fees

You get the full APY from Day 1

Extremely fast ACH transfers

❌ Cons:

No ATM access

Limited features beyond saving

📝 How to Apply:

Visit ufbdirect.com

Apply online and fund your account

Start earning 5.25% immediately

🥉 Primis Bank Savings Account

APY: 5.07% APY

Monthly Fees: None

FDIC Insurance: Yes

Minimum Balance: None

🔍 Features:

Free online banking & mobile app

Great for short-term saving goals

No direct deposit needed for high APY

✅ Pros:

Simple to use

No hidden requirements

Excellent mobile reviews

❌ Cons:

Limited in-branch access (Virginia-based)

ACH transfers may take 1–2 days

📝 How to Apply:

Go to primisbank.com

Click “Open an Account”

Fund via ACH or debit

How to Choose the Right High-Yield Savings Account

When comparing savings accounts, don’t just chase the highest APY. You need the right blend of yield, flexibility, and trust.

📌 Key Factors to Consider:

APY (Annual Percentage Yield): Look for 5% or more—but check if it requires direct deposit.

Monthly Fees: Always choose accounts with $0 monthly maintenance fees.

Access to Funds: Can you transfer funds easily via ACH or app?

Withdrawal Limits: Federal Regulation D was relaxed during COVID, but some banks still limit withdrawals.

Mobile App & Customer Service: A strong, responsive mobile experience is essential in 2025.

🧠 Pro Tips:

Avoid “teaser” APYs that drop after a few months. Read the fine print.

Use platforms like NerdWallet, Bankrate, or Reddit’s r/personalfinance to stay updated.

Don’t close your old account right away. Let deposits settle before switching entirely.

Common Mistakes to Avoid When Opening an HYSA

🚫 Mistake 1: Falling for Teaser Rates

Some banks advertise 5.00% APY but slash it to 0.50% after 90 days. Always check for promotional period limits.

🚫 Mistake 2: Ignoring Withdrawal Restrictions

Some online banks limit you to 6 withdrawals per month. Exceeding this may incur fees or account conversion.

🚫 Mistake 3: Not Reading Minimum Balance Terms

An account may advertise high APY but require a $5,000 balance. Always confirm the terms.

🚫 Mistake 4: Overlooking FDIC Status

Ensure the bank is FDIC-insured. Never stash large sums in non-insured accounts.

Step-by-Step Guide to Opening a High-Yield Savings Account

Here’s how to get started in under 15 minutes:

🔑 Step 1: Compare Accounts

Use tools like NerdWallet, Bankrate, and Reddit discussions to compare live APYs and reviews.

✍️ Step 2: Choose & Apply Online

Visit the bank’s official site and click “Open Account.” You’ll need:

Social Security Number (SSN)

Valid ID

Existing bank info for funding

💰 Step 3: Fund the Account

Link your checking account and transfer funds. Most banks allow ACH transfers, debit card funding, or direct deposit.

🔁 Step 4: Set Up Auto-Deposits

Automate your savings with recurring transfers (e.g., $100/week).

📲 Step 5: Monitor Your Earnings

Use the bank’s app to check your balance, track growth, and adjust goals.

Conclusion

Why settle for 0.45% APY when you can earn 5% or more—risk-free and FDIC-insured?

With top-tier options like SoFi, UFB Direct, and Primis Bank, 2025 is the perfect year to upgrade your savings strategy. Whether you're building an emergency fund or saving for a down payment, these accounts give your money the growth it deserves.

💡 Your savings deserve better. Don’t let banks underpay you—make the switch today.

FAQs

❓What is the best high-yield savings account in the USA for 2025?

Currently, UFB Direct offers the highest APY at 5.25% with no balance requirements or direct deposit needed.

❓Are high-yield savings accounts FDIC-insured?

Yes, all accounts mentioned—SoFi, UFB Direct, and Primis Bank—are FDIC-insured up to $250,000.

❓Do online banks really offer better APY?

Yes. Online banks have lower overhead and pass the savings to customers via higher APYs and fewer fees.

❓Can I lose money in a high-yield savings account?

No, as long as it's FDIC-insured, your principal is secure up to $250,000 per depositor, per bank.

❓How often is interest paid on high-APY accounts?

Most high-yield accounts compound interest daily and pay monthly, giving you faster growth.

❓What’s the minimum to open these accounts?

All recommended banks in this article have no minimum balance requirements.

Comments

Post a Comment

https://thesavvysaversociety.blogspot.com/p/comment-policy.html