The 50/30/20 Budgeting Rule: Free Spreadsheet to Manage Your Money

Managing money doesn’t have to be overwhelming, especially when you’re juggling rent, Netflix subscriptions, and that emergency fund you’ve been meaning to start. If you’re a millennial, Gen Z’er, working professional, or young family earning between $40K and $120K, the 50/30/20 budgeting rule might just be the simple, flexible solution you’ve been searching for. Even better?

We’ve got a free budgeting spreadsheet to help you put this plan into action today.

Ready to take control of your finances, reduce stress, and start building savings?

Let’s dive in!

Why the 50/30/20 Rule Works for Everyone

The 50/30/20 budgeting rule is a straightforward way to divide your after-tax income into three categories: “needs”, “wants”, and “savings or debt repayment”. Introduced by Senator Elizabeth Warren in her book “All Your Worth”, this method has gained popularity because it’s easy to understand and works for almost any income level—whether you’re making $3,000 a month or $10,000.

Why does it resonate with middle-class Americans? It’s flexible enough to fit your lifestyle, whether you’re saving for a house, paying off student loans, or just trying to stop overspending on takeout.

Plus, with our free 50/30/20 budgeting spreadsheet, you can start organizing your finances in minutes. Let’s break it down!

How the 50/30/20 Rule Works (With a Real-World Example)

Here’s the magic formula:

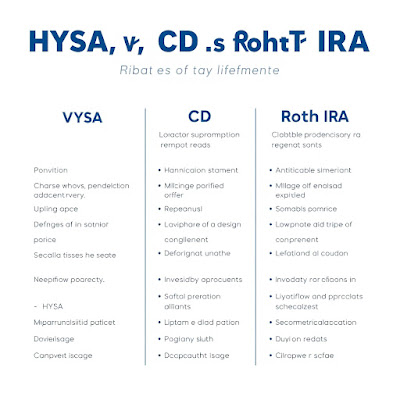

- 50% for Needs: These are essentials you can’t live without—think rent or mortgage, groceries, utilities, transportation, and insurance.

- 30% for Wants: This covers the fun stuff—dining out, streaming services, travel, or that new pair of sneakers you’ve been eyeing.

- 20% for Savings & Debt Repayment: Build your emergency fund, invest for the future, or tackle credit card debt and student loans.

Example: $5,000 Monthly Income

Let’s say you’re a 30-year-old graphic designer in Austin, Texas, bringing home $5,000 a month after taxes. Here’s how the 50/30/20 budgeting rule shakes out:

- Needs (50% = $2,500):

- Rent: $1,400

- Groceries: $400

- Car payment + gas: $350

- Utilities: $200

- Health insurance: $150

- Wants (30% = $1,500):

- Dining out: $300

- Streaming services (Netflix, Spotify): $25

- Weekend trips: $500

- Shopping: $675

- Savings & Debt (20% = $1,000):

- Emergency fund: $500

- Student loan payment: $500

This breakdown keeps your essentials covered, lets you enjoy life, and ensures you’re making progress toward financial security. Want to see how it works for your income? Grab our free budgeting spreadsheet below!

Free 50/30/20 Budgeting Spreadsheet Download

Ready to manage your money effectively? Our personal finance tracker does the heavy lifting for you. Here’s how to get started:

Step-by-Step Guide to Using the Spreadsheet

1. Download the Spreadsheet: Click the link below to get your free copy.

2. Input Your Monthly Income: Enter your after-tax income at the top.

3. Watch the Magic Happen: The spreadsheet automatically calculates your 50/30/20 allocations.

4. Track Your Spending: Log your expenses in each category to see where your money’s going.

5. Adjust as Needed: Overspent on wants? Cut back next month to stay on track.

“[Download your free budgeting spreadsheet now!] (Link coming soon—sign up for our email list to get it first!)”

This tool is perfect for beginners and pros alike—simple enough for budgeting newbies, yet detailed enough to refine your financial habits.

Customizing the 50/30/20 Rule for Your Lifestyle

The beauty of the 50/30/20 budgeting rule is its flexibility. One size doesn’t fit all, so feel free to tweak the percentages based on your situation:

- Low-Income Households ($40K-$60K): If rent and groceries eat up more than 50%, try a 60/20/20 split. Focus on needs first, then squeeze wants and savings into smaller portions.

- High-Income Earners ($100K+): Got extra cash after covering basics? Boost savings to 30% or 40% to fast-track retirement or investments.

- Debt-Payers: Struggling with loans? Shift to a 40/30/30 split to pay off debt faster while still enjoying life.

For example, Sarah, a 27-year-old teacher in Chicago earning $3,500 monthly, adjusts to 60/20/20 because her rent is sky-high. Meanwhile, Mike, a 38-year-old software engineer in Seattle pulling in $8,000, uses a 40/20/40 split to max out his 401(k). The key?

Make it work for you.

Common Budgeting Mistakes (and How to Avoid Them!)

Even with the 50/30/20 budgeting rule Pitfalls happen. Here’s how to dodge them:

🚫 Mistake 1: Underestimating “Wants” Expenses

You think $300 covers dining out, but then UberEats hits $500.

Solution: Track your spending for 30 days using an app like [Mint](#) or our spreadsheet to get a realistic picture before setting limits.

🚫 Mistake 2: Ignoring “Emergency Savings”

Skipping that 20% savings chunk? Life happens—car repairs, medical bills—and you’ll wish you’d started small.

Solution: Save at least $500-$1,000 first, even if it means cutting wants temporarily.

🚫 Mistake 3: Using Credit Cards to Cover “Needs”

If rent and groceries exceed 50%, don’t swipe the card to bridge the gap.

Solution: Trim subscriptions, negotiate bills, or pick up a side hustle to boost income.

Take Control of Your Finances Today

The 50/30/20 budgeting rule isn’t just a formula—it’s a mindset shift. It empowers you to enjoy life, cover essentials, and build a safety net, no matter where you’re starting. Whether you’re a 24-year-old barista or a 40-year-old parent, this method scales to fit your goals.

Additional Resources

- Books: Your Money or Your Life by Vicki Robin

- Blogs: The Budgetnista (great for beginners!)

- Courses: Ramsey Solutions’ Financial Peace University

With the 50/30/20 budgeting rule and a trusty personal finance tracker, you’re on your way to less stress and more savings. What’s your first step? Let us know in the comments!

Comments

Post a Comment

https://thesavvysaversociety.blogspot.com/p/comment-policy.html