From Zero to $5,000 Savings in 90 Days

Ever felt like saving a serious chunk of cash was just out of reach? You're not alone. Life throws bills, emergencies, and temptations at us like a never-ending dodgeball game. But what if I told you it’s totally possible to go from $0 to $5,000 in just 90 days? It’s not magic — it’s mindset, action, and a little creativity.

So, Are you ready to save $5,000 fast in the USA without flipping your whole life upside down?

Good news — it’s absolutely possible, even if you're living pay check-to-pay check. In this guide, we’ll show you a realistic 90-day savings challenge that's practical, motivating, and built for real life in 2025.

Meet Jasmine: Your 90-Day Saving Inspiration

Meet Jasmine Carter, a 30-year-old Junior Project Manager from Denver, Colorado.

She earns $48,000 a year — not bad, but after rent, bills, and a few Amazon splurges, her savings account barely had $200. Jasmine’s dream?

Save $5,000 in 90 days to move into a better apartment and build emergency fund security for 2025.

At first, Jasmine felt overwhelmed by all the vague "just save more" advice online. She needed real numbers. Real steps. Real motivation.

Sound familiar? If yes, keep reading — because this 90-day action plan could change everything.

🎯 The Big Goal: Save $5,000 in 90 Days

Before we dive into strategies, let’s break down what saving $5,000 in 90 days actually means:

$55.56/day

$385/week

$1,666/month

Read Also:- 5 Genius Ways to Save Money Without Sacrificing Life

👉 It sounds big, but when you focus week-by-week, it becomes manageable.

This guide focuses on how you can save $5,000 fast USA style — without extreme deprivation — just smarter habits and extra income.

Calculate Your $5,000 Plan

First, grab a notebook or your favourite budgeting app.

Break down your $5,000 savings goal into weekly chunks:

💡 Pro Tip: Set weekly mini-goals. Celebrate every $100 milestone to stay pumped!

👉7 Smart Ways to Save Money in the USA: Best Daily Deposit Strategies for 2025

Create a "No Excuses" Budget

To hit this goal, you must prioritize ONLY essentials:

Rent/Mortgage

Utilities

Groceries

Transportation

That’s it — for 90 days, no new clothes, no random Target runs, no $6 coffees.

Use Free Budgeting Templates:

Every Dollar

Both offer easy starter templates to get you laser-focused!

Slash Non-Essential Spending Fast

Small leaks sink big ships. Find and fix them FAST:

Cancel subscriptions (Netflix, Spotify, etc.)

Pause restaurant visits — cook at home

Unsubscribe from shopping emails

Implement a 48-hour rule before any non-essential purchase

Easy Wins:

✅ Save $300–$500/month just by cutting non-essentials.

Launch a 90-Day Side Hustle

Adding income is faster than cutting everything fun.

Start a quick side hustle for 90 days:

👉 2025 Hot Tip: Try flexible gigs like Instacart shopping, Amazon Flex, or local gig apps.

Sell 10 Things You Don't Use

Jasmine made $850 in her first two weeks — just by selling stuff she didn’t need!

Where to sell:

Facebook Marketplace (local & free)

eBay (best for collectibles)

Offer Up (easy mobile app)

Ideas:

Old electronics, furniture, clothing, fitness gear, books.

Save Every Windfall (Tax Refund, Gifts, Bonuses)

Don't blow surprise money — save it!

Real stories show people saving $1,000+ just from:

Tax refunds

Birthday gifts

Annual bonuses

Rebates and cashbacks

Pro Move: Pre-plan: "Every windfall = savings first."

Use the "Separate Savings Account Trick"

Open a dedicated online savings account — don't mix with checking!

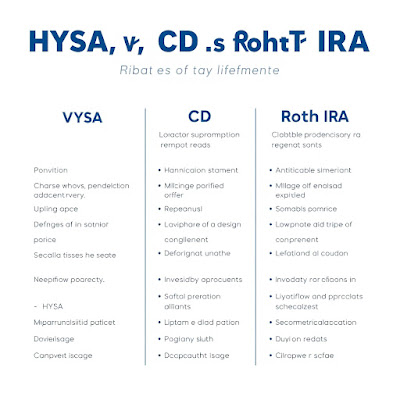

Top banks offering 4%+ APY in 2025:

Sofi Money

Capital One 360 Performance Savings

💡 Bonus Tip: Rename your account "Apartment Fund" to stay inspired.

Track Progress Weekly (and Celebrate Tiny Wins)

Use a free printable tracker or apps like Mint.

Gamify your savings:

Earn badges

Reward yourself with a $5 treat every $500 milestone

Share your progress with friends or a savings buddy

Remember: Progress > perfection.

💪 Common Challenges & How to Stay Motivated

Tempted to splurge? Pause, breathe, visualize your new apartment.

Side hustle feels exhausting? Break tasks into 30-minute bursts.

Slow weeks? Double-down next week — no guilt.

👉 Reinforce this:

Saving $5,000 will create the freedom and security you've dreamed about.

💬 FAQ Section

Is it really possible to save $5,000 in 90 days?

Yes! If you follow a structured plan (cut spending + add income), many Americans are hitting $5K in 90 days even in 2025.

How do I stay disciplined while saving aggressively?

Weekly tracking, celebrating mini-wins, using visual goals (like dream apartment photos) keep motivation high.

What side hustles pay the fastest in the USA?

Food delivery apps like Uber Eats, freelance gigs on Fiverr, and quick-turnaround remote tasks on Upwork pay fastest in 2025.

Should I put all $5,000 into a savings account or invest?

Start by putting the full $5,000 into a high-yield savings account to keep it safe and liquid. Invest later after building your emergency cushion.

How can I budget better after hitting my savings goal?

Use the same "no excuses" budgeting skills — but allow a small monthly "fun" budget to stay balanced long-term.

📝 Final Takeaway

If Jasmine can do it, you can too.

Saving $5,000 fast in the USA isn’t a fantasy — it’s a focused mission.

Start today. Break it down. Celebrate small wins.

Three months from now, your future self will thank you.

Conclusion: You Can Save $5,000 — Starting Today

Saving $5,000 in just 90 days might sound bold, but as you’ve seen, it’s absolutely possible with a smart plan, daily action, and a little creativity. Whether you're building your first emergency fund or setting up a fresh start in a new apartment like Jasmine, the steps are realistic — not extreme.

By breaking down the goal into small, manageable pieces, cutting unnecessary spending, picking up quick side gigs, and using every windfall wisely, you can save $5,000 fast USA without flipping your entire life upside down.

Remember: every dollar you save is a step toward freedom, peace of mind, and a stronger financial future. Start today, stay focused, and in just three months, you’ll be celebrating a huge win that sets the tone for the rest of your financial journey in 2025 and beyond.

Final Summary:

🎯 Goal: Save $5,000 in 90 days (about $55/day).

📋 Plan: Create a no-excuses budget, slash extras, boost income fast.

🛠️ Tools: Free budgeting apps (YNAB, Every Dollar), online savings accounts with 4%+ APY.

🚀 Fast Actions: Side hustles, selling unused items, saving windfalls.

💪 Mindset: Focus on tiny wins, stay consistent, gamify the challenge.

👉 Ready to start your realistic 90-day savings challenge? Your future self will thank you!

Comments

Post a Comment

https://thesavvysaversociety.blogspot.com/p/comment-policy.html