How to Save $500 Fast in 30 Days: Money-Saving Hacks for Women Living Paycheck to Paycheck

Introduction: The $500 Challenge — Yes, You Can Do It!

Are you tired of living paycheck to paycheck? You’re not alone. In fact, nearly 63% of Americans say they would struggle to cover a $500 emergency. But here's the good news: it’s absolutely possible to save $500 in 30 days — even if you're on a tight budget.

Whether you need a rainy-day fund, want to pay off debt, or are just craving financial peace of mind, this guide is for you. This isn’t about skipping every pleasure — it’s about practical, doable strategies tailored for women who manage households, juggle jobs, and stretch every dollar.

Let’s break it down with weekly action steps, cost-cutting ideas, money-saving hacks USA style, and a real-life example to inspire you.

🔥 30-Day Action Plan to Save $500 Fast

Saving $500 in 30 days might feel impossible at first glance, but by dividing the goal into weekly mini-targets, you’ll build momentum and stay motivated. This plan combines spending cuts + extra income to get real, measurable results.

✅ Overall Goal: Save or Earn $125 Every Week

You can break that down into something like:

$75 from cutting back on spending

$50 from selling or earning on the side

Let’s dive into the details!

🗓️ Week 1: Track Every Dollar Like a Boss

🎯 Weekly Goal: Identify and cut at least $75–$100 in wasteful spending

You can’t save what you don’t track.

🔍 Step-by-Step Plan:

1. Download a Free Budgeting App

Use Mint, EveryDollar, or YNAB (free trial)

Link your bank/credit card for real-time tracking

2. Categorize All Your Spending

Break your expenses into:

Essentials: Rent, food, gas, utilities

Wants: Coffee shops, dining out, Netflix, Amazon orders

3. Highlight Non-Essentials

Look for:

Daily $5 coffee? That’s $150/month

Uber rides vs. public transport?

Overlapping subscriptions?

4. Make Cuts Immediately

Cancel, downgrade, or pause:

Streaming services (keep only 1)

Auto-ship beauty boxes or Amazon orders

Gym membership (try free YouTube workouts)

5. Set a Cash Budget for Groceries

Try $50–$70 per week with a strict list.

Use coupons (via Flipp, Ibotta) and avoid impulse buys.

✅ Result:

👉 If you cut $5–$10/day in wasteful spending this week, you’ll save $35–$70 or more.

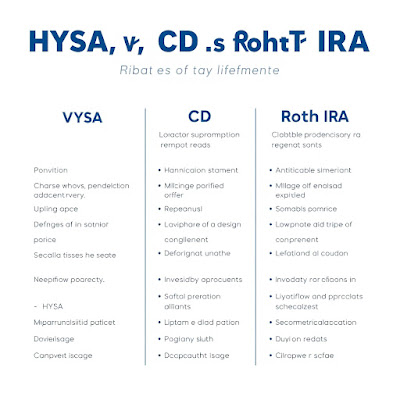

Looking for the best savings accounts in 2025? We’ve found the top 3 banks offering 5%+ APY—secure, FDIC-insured, and hassle-free! click 👉The 3 Best High-Yield Savings Accounts for 2025 (5% APY Guaranteed)

🗓️ Week 2: Sell Your Stuff — Fast!

🎯 Weekly Goal: Earn $100–$150 from selling unused items

Your clutter is someone else’s treasure — and cash in your pocket.

💡 Step-by-Step Plan:

1. Look Around for Easy-to-Sell Items

Start with:

Clothing (especially name brands)

Old phones, headphones, chargers

Unused appliances (coffee maker, toaster)

Kids’ clothes or toys

Books and decor

2. Take Good Photos + List Them

Use platforms like:

Facebook Marketplace (local, fast)

OfferUp (great for gadgets)

Poshmark (clothes, shoes)

Mercari (everything!)

Post clear, honest descriptions. Use keywords like:

“Barely used Air Fryer – $30 OBO – works perfectly!”

“Size 8 Target boots – Worn 1x – $12”

3. Join Local Buy/Sell/Trade Groups

These work best for quick local sales with no shipping.

4. Host a Mini Yard Sale (If Possible)

Even a one-day event in your front yard or apartment lobby can pull in $50–$100.

✅ Result:

👉 Sell 5–10 items at $10–$30 each = $100–$150 fast cash.

🗓️ Week 3: Slash Your Monthly Bills

🎯 Weekly Goal: Save $75–$125 from reducing fixed expenses

You’re likely overpaying — let’s fix that.

💸 Step-by-Step Plan:

1. Call Your Service Providers

Negotiate better rates on:

Internet or cable (bundle or threaten to cancel)

Cell phone plan (switch to prepaid or family plan)

Car insurance (ask for low-mileage discount)

Use negotiation scripts like:

2. Pause or Cancel Subscriptions

Cancel services you haven’t used in 30 days:

Gym memberships

Streaming (Netflix, Hulu, Spotify)

Monthly boxes (FabFitFun, beauty, wine)

💡 Hack: Share plans with trusted friends or family.

3. Switch to Meal Prep at Home

No takeout this week — cook all meals

Plan 4–5 meals using cheap staples (pasta, beans, eggs, frozen veggies)

Shop once, stick to the list

4. Unplug Devices

Unplug appliances when not in use. Phantom power adds up!

5. Use Energy-Saving Tricks

Wash clothes in cold water

Use shorter showers

Turn off lights

✅ Result:

👉 Cutting recurring bills + food spending = $100 saved easily this week

🗓️ Week 4: Make Extra Money with Side Hustles

🎯 Weekly Goal: Earn $150–$200 in side income

Even with limited hours, you can earn more this week.

💼 Step-by-Step Plan:

1. Try a Fast Gig Platform

DoorDash / Uber Eats (Evenings = $15–$25/hr)

TaskRabbit (help people move, clean, assemble furniture)

Instacart (grocery delivery)

Work just 2 hours a day = up to $200/week

2. Freelance Online

Write, design, or do virtual admin work on Fiverr or Upwork

Example: 1 simple Canva flyer = $10–$20

3. Offer Local Help

Babysit for neighbors

Pet sit or dog walk using Rover

Help with spring cleaning for elderly folks nearby

4. Cashback from Everyday Spending

Use Fetch Rewards, Upside, Ibotta

Grocery shopping? Scan your receipts and earn $5–$20/week

5. Sell a Digital Product

Create and sell:

A printable budget tracker

A meal planner

A self-care checklist

Sell it on Etsy or Gumroad — even 5–10 sales can earn $50–$100.

✅ Result:

👉 With just 6–8 hours of side work this week = $150–$200

🎉 Final Summary: What You Could Save in 30 Days

💖 Motivation to Keep Going

Each week you take action, you’ll feel more in control — and less stressed.

Even if you only hit 80% of your goal, you’ll still end up with $400+ saved — and the habits you build will help you keep saving month after month.

💡 Top 15 Practical Ideas to Cut Costs Quickly

These aren’t just “skip lattes” tips — they’re real, proven hacks that could help you shave $10, $20, or even $100+ per week off your budget. Mix and match what fits your life!

1. 🛒 Meal Prep Instead of Eating Out

Why it works: Cooking your own food can cut your food spending in half.

What to do:

Plan 3–5 simple meals per week (like stir-fry, pasta, soups, wraps)

Cook in bulk on Sunday and store in containers

Use leftovers creatively (turn grilled chicken into tacos or salads)

Estimated Savings: $40–$100/week

Example: $12 lunch out x 5 days = $60 vs. $15–$20/week in home groceries

2. 🎬 Cancel or Pause Streaming Services

Why it works: Many people pay for 3–5 platforms but only use one or two.

What to do:

Keep only your most-watched one (e.g., Netflix or Hulu)

Share accounts with trusted friends/family (one pays for Netflix, one for Prime)

Rotate monthly (watch everything in 1 month, cancel, try another next month)

Estimated Savings: $10–$50/month

3. ☕ Ditch Daily Coffee Shop Visits

Why it works: A daily $5 coffee = $150/month you may not notice.

What to do:

Brew at home (use flavored creamers or syrups for variety)

Invest in a reusable tumbler for work or on the go

Try instant cold brew packets (cheaper and fast)

Estimated Savings: $25–$100/month

4. 🚫 Unsubscribe from “Retail Temptation” Emails

Why it works: Retailers want you to impulsively spend.

What to do:

Unsubscribe from Amazon, Shein, Target, Sephora, etc.

Use inbox filters to move ads to a “deals” folder

Replace online browsing with Pinterest boards for “future wants”

Estimated Savings: Avoid 1–2 impulse buys/week = $20–$50/week

5. 🧾 Use Grocery Rebate & Coupon Apps

Why it works: You can earn back 5–10% of what you already spend.

What to do:

Use apps like Ibotta, Fetch, Upside, and Flipp

Scan receipts and get gift cards or cash

Use digital coupons before checkout at stores like Walmart or Kroger

Estimated Savings: $5–$15/week

6. 📱 Switch to a Cheaper Phone Plan

Why it works: Many people overpay by $30–$50/month.

What to do:

Move to a prepaid or MVNO carrier like Mint Mobile, Tello, or Visible

Use Wi-Fi for most calls and texts

Check for employer discounts or bundles with home internet

Estimated Savings: $20–$60/month

7. 🚗 Carpool or Use Public Transport

Why it works: Gas and rideshare costs can drain your cash.

What to do:

Share a ride to work with coworkers or neighbors

Use local buses or trains for commuting

Batch errands to avoid unnecessary trips

Estimated Savings: $10–$50/week depending on distance

8. 🏡 Cut Utility Costs

Why it works: Small changes = big savings over time

What to do:

Lower your thermostat in winter and raise it in summer by 2–4 degrees

Use fans, open windows, or space heaters wisely

Wash clothes in cold water; hang dry when possible

Estimated Savings: $15–$40/month

9. 🛏️ Do a “No-Spend Weekend”

Why it works: Most overspending happens on weekends

What to do:

Plan free activities: hike, movie night at home, picnic

Use things you already own: board games, books, DIY spa days

Meal prep with what’s in your pantry (a “use what you have” challenge)

Estimated Savings: $30–$100 per weekend

10. 🎁 Gift with Purpose or DIY

Why it works: You can be thoughtful without going broke.

What to do:

Set a monthly gift budget (e.g., $10–$15 max per person)

Make gifts: photo frames, baked treats, custom playlists, hand-written notes

Reuse gift bags or wrap with brown paper and twine

Estimated Savings: $20–$50 per event

11. 💅 Pause Salon & Beauty Appointments

Why it works: DIY grooming = huge savings

What to do:

Learn basic nail care or hair trimming from YouTube

Stretch appointments (e.g., go from 3 to 6 weeks for brows or nails)

Use drugstore beauty dupes for luxury items

Estimated Savings: $30–$100/month

12. 🧺 Use What You Already Have

Why it works: Most of us have duplicates or forgotten items.

What to do:

Do a “pantry challenge” — don’t shop until you’ve used up your current food

Inventory your bathroom — stop buying more shampoo or lotion until you finish current stock

Rotate your wardrobe instead of buying new clothes

Estimated Savings: $25–$75/month

13. 💳 Pay Only with Cash (Envelope Method)

Why it works: It limits impulse spending

What to do:

Withdraw exact weekly cash budget for groceries, gas, personal spending

Use envelopes labeled with categories

When an envelope is empty — no more spending!

Estimated Savings: $50–$150/month in reduced overspending

14. 🎓 Use Your Library for More Than Just Books

Why it works: Libraries are a goldmine of free stuff

What to do:

Borrow movies, ebooks, audiobooks, cookbooks

Attend free classes or workshops (some offer finance or parenting classes)

Some offer free streaming, resume reviews, or even passes to museums

Estimated Savings: $10–$50/month in subscriptions, classes, or rentals

15. 📅 Plan Your Spending Weekly (Not Monthly)

Why it works: Weekly budgets keep you focused and adaptable

What to do:

Break your monthly income into 4 weekly budgets

Track food, gas, and extras each Sunday night

Review: “What went over? What can I fix this week?”

Estimated Savings: Helps you catch overspending early — savings of $25–$75/month

🧮 Recap: Total Potential Monthly Savings

Conclusion: You Have the Power to Change Your Financial Future

Saving $500 in just 30 days might sound like a stretch — but with small, intentional actions, it’s 100% possible. Whether you’re cutting costs, selling extra stuff, or side hustling on weekends, your financial transformation starts today.

You’ve got this. ✨

👉 Next Step: Check out our guide on “10 Smart Ways to Budget on a Minimum Wage” to keep your momentum going!

FAQ: Save $500 in 30 Days — Your Questions Answered

1. Can I really save $500 in 30 days on a minimum wage job?

Yes! Even if your income is tight, by combining spending cuts, selling items, and picking up a small side hustle, you can make it happen.

2. What if I have kids and no free time?

Start with what you can control — like cutting expenses and selling unused items. Even small wins add up.

3. How do I stay motivated for 30 days?

Visualize your goal — print it out, set reminders, involve a friend, and reward yourself for small milestones.

4. What’s the fastest way to save money today?

Sell something you don’t use — electronics, clothes, small furniture. You could make $50–$100 in a day.

5. Do I need a fancy budget planner?

Nope! You can use a notebook or free apps like Mint or YNAB.

6. Should I stop all fun spending?

Not at all. Budget a small amount for joy — just be intentional. Fun doesn’t have to be expensive.

Comments

Post a Comment

https://thesavvysaversociety.blogspot.com/p/comment-policy.html