Financial Tips for Single Moms in 2025: From Surviving to Thriving

Being a single mom in 2025 comes with incredible challenges—but also opportunities to rise stronger. This blog is your go-to guide for practical, empowering financial tips designed specifically for single mothers in the U.S. living on a tight income. Whether you're juggling rent, groceries, or childcare costs, this post walks you through real-life solutions that work.

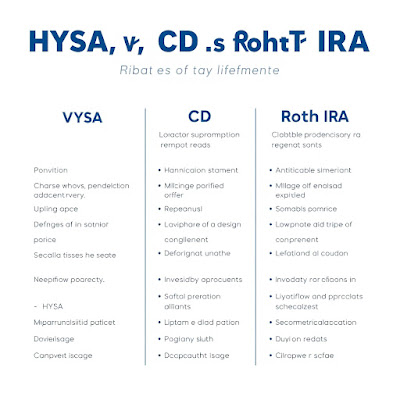

We explore budgeting hacks like using the 50/30/20 rule, leveraging programs such as SNAP, WIC, Section 8 housing, and free tools like EveryDollar and Mint to manage your money. You'll find advice on stretching every dollar, tackling debt, building emergency savings—even when you're earning less. Plus, we've included inspirational stories from moms who went from barely getting by to feeling financially secure.

With detailed tips on managing utilities, applying for childcare grants, and accessing free financial counseling, this blog offers a realistic path to financial stability. We've also included internal links to more budgeting, debt payoff, and saving resources you can use today.

Introduction: You’ve Got This, Mama!

Being a single mom is a full-time job—and then some. Between raising kids, managing a home, and bringing in income, every dollar has a purpose. If you're living paycheck to paycheck, juggling bills, and wondering how to stretch your income even further, you're not alone.

In 2025, there are more tools, programs, and support than ever before designed to help you not just survive—but thrive.

This guide offers realistic, doable financial tips for single moms in 2025, covering everything from budgeting to government assistance, free resources, and inspirational success stories from moms just like you.

Let’s get started!

1. Create a Survival Budget That Works for You

Budgeting on One Income with Kids Doesn’t Have to Be Overwhelming

Start with a simple zero-based budget. Every dollar you bring in should be assigned a job—whether it's covering rent, buying diapers, or saving for emergencies.

Use these free budgeting tools just for single moms:

🧾 You Need A Budget (YNAB) – Free for 34 days. Great for goal-based budgeting.

💵 EveryDollar – A clean, simple app with a free version.

🏠 MyBudgetCoach™ by Compass Working Capital – Helps moms track income, spending, and goals.

👉 Pro Tip: Prioritize needs over wants. If you have $2,000/month, decide:

$800 for rent (use Section 8 if eligible!)

$400 groceries (use SNAP if you qualify)

$200 transportation

$100 utilities

$200 childcare (see Head Start program below)

$100 savings

$200 flex expenses

2. Tap Into Government Programs for Single Moms in 2025

You don’t have to do this alone. The U.S. government and non-profits offer money help for single mothers USA-wide, especially if you’re on a low income.

Updated Benefits You May Qualify for in 2025:

📦 SNAP (Supplemental Nutrition Assistance Program)

Provides food assistance.

Average benefit: $230 per person/month.

Apply at Benefits.gov

🏡 Housing Choice Vouchers (Section 8)

Subsidized rent based on your income.

Long waitlists, so apply early via your local PHA: HUD Locator

💡 LIHEAP (Low Income Home Energy Assistance Program)

Helps with utility bills, AC, and heating.

Apply via energyhelp.us

👶 Head Start / Early Head Start

Free childcare and early education for kids 0–5.

Find a program near you

🍼 WIC (Women, Infants, and Children)

Provides formula, baby food, and groceries for pregnant moms and kids under 5.

Check WIC eligibility

3. Side Hustle Smart: Flexible Income Ideas for Single Moms

You can earn extra income without a second full-time job.

Flexible Side Hustles You Can Do With Kids:

Virtual Assistant – Work from home with flexible hours.

Resell Kids’ Clothes or Toys – Use Facebook Marketplace, Kidizen

Pet Sitting or Dog Walking – Try Rover

4. Slash Bills with These Budget Hacks

Even small changes can save hundreds per year.

Utilities & Services:

Negotiate Your Internet Bill – Ask about low-income plans like Xfinity’s Internet Essentials ($9.95/month).

Switch to a Prepaid Cell Plan – Try Mint Mobile or Tello ($10–$20/month).

Apply for ACP (Affordable Connectivity Program) – Free/reduced broadband: acpbenefit.org

Groceries:

Use rebate apps like:

Shop clearance hours – Many stores mark down produce and meat after 7 PM.

Use SNAP at Farmers Markets – Many double your benefits!

Childcare:

Ask About Subsidized Child Care via your state.

Barter with another mom—watch each other’s kids once a week!

5. Start a Small Emergency Fund (Even if It's $5/week)

A $300 emergency fund can keep you out of debt when your car breaks down or you miss a shift at work.

How to Start:

Open a free online savings account (Ally, Chime, Capital One 360).

Automate even $5/week into it.

Keep it out of reach (don’t link it to your debit card!).

6. Use the Envelope Method (Digital or Cash)

This classic method still works—especially on a tight budget.

How it Works:

Divide your monthly income into categories: groceries, gas, childcare, fun.

Put cash in labelled envelopes (or use budgeting apps with digital envelopes).

Spend only what's in each envelope.

Recommended Apps:

Good budget – Best for envelope-style budgeting.

Melones – Works like cash envelopes but online.

7. Find Free Financial Coaching for Moms

Many non profits offer free 1-on-1 financial coaching, helping with:

Credit repair

Budgeting

Debt payoff

Goal setting

Where to Look:

Green Path Financial Wellness (greenpath.com)

Your local YWCA or United Way

National Foundation for Credit Counselling – nfcc.org

👩👧👦 Real Mom Story:

Laura, a mom from Arizona, got free coaching from United Way. Within 9 months, she paid off a $1,200 credit card and raised her credit score from 580 to 660!

8. Cut Debt With These Easy-to-Follow Steps

If you’re carrying credit card, car loan, or medical debt, here’s how to tackle it on one income:

Single Mom Saving Tips to Get Out of Debt:

List your debts from smallest to largest.

Make minimum payments on all except the smallest.

Put extra cash (tax refunds, side hustle income) toward the smallest.

Repeat the process until you’re debt-free!

This is called the Debt Snowball Method.

9. Use Tax Refunds and Credits to Your Advantage

In 2025, you may qualify for:

Earned Income Tax Credit (EITC) – Up to $7,830 depending on your income and number of kids.

Child Tax Credit – Up to $2,000 per child under 17.

American Opportunity Tax Credit – If you’re in school or paying tuition.

How to Maximize Your Refund:

File early with a free tax prep program:

IRS Free File

Use part of your refund to:

Pay off debt

Start savings

Stock up on non-perishable groceries or kids’ essentials

10. Practice Self-Care Without Spending a Fortune

Taking care of YOU is part of your financial health.

Low-Cost Self-Care Ideas:

Walks at the park with your kids

Free YouTube workouts

Journaling or listening to meditation apps (try Insight Timer or Shine)

Free local mom groups via Meetup

11. Set Realistic Goals and Celebrate Progress

Success isn't just paying off $10K of debt—it’s paying off $10 this week when last week you couldn’t.

Try This:

Set a weekly money goal (save $5, use only $100 groceries).

Write down ONE win each Friday.

Teach your kids by example. Let them help clip coupons or shop with a small budget.

Conclusion: You’re Not Alone—And You’re Stronger Than You Think

Being a single mom in 2025 is challenging—but also filled with opportunity. You’re already doing the hardest job in the world. With a few smart tweaks, the right resources, and ongoing support, you can create a stable, secure, and hopeful future for yourself and your kids.

Whether you’re just starting your money journey or making progress on your goals, remember: Every step counts.

FAQs: Financial Help for Single Moms in the USA

1. What is the best budgeting method for single moms?

The zero-based budgeting method works well. Apps like EveryDollar and YNAB help assign every dollar a job, making budgeting on one income easier.

2. Are there any grants or programs for single mothers in the USA in 2025?

Yes! Programs like SNAP, Section 8, WIC, Head Start, and LIHEAP are all available and updated for 2025.

3. How can I make extra money as a single mom?

Try flexible side hustles like freelance work, tutoring, or selling unused items. Apps like Upwork and Rover offer flexible ways to earn at home.

4. Can I get help with childcare costs?

Yes, many states offer subsidized child care . You can also use the Head Start program or trade childcare with another trusted mom.

5. What is the best way to start saving money on a low income?

Start small—just $5/week. Automate savings into a free high-yield savings account and use apps like Ibotta for grocery rebates.

6. Are there any scholarships for single moms going back to school in 2025?

Yes! Look into the Pell Grant, Raise the Nation, and Live Your Dream Award by Soroptimist. Check Scholarships.com for more.

Comments

Post a Comment

https://thesavvysaversociety.blogspot.com/p/comment-policy.html